A reader asks:

What’s the biggest risk in the markets right now?

The simple answer here is the one everyone has been preparing for over the past 24 months — a recession.

In the post-WWII era, the U.S. economy has slipped into a recession roughly once every 5 years or so, on average.

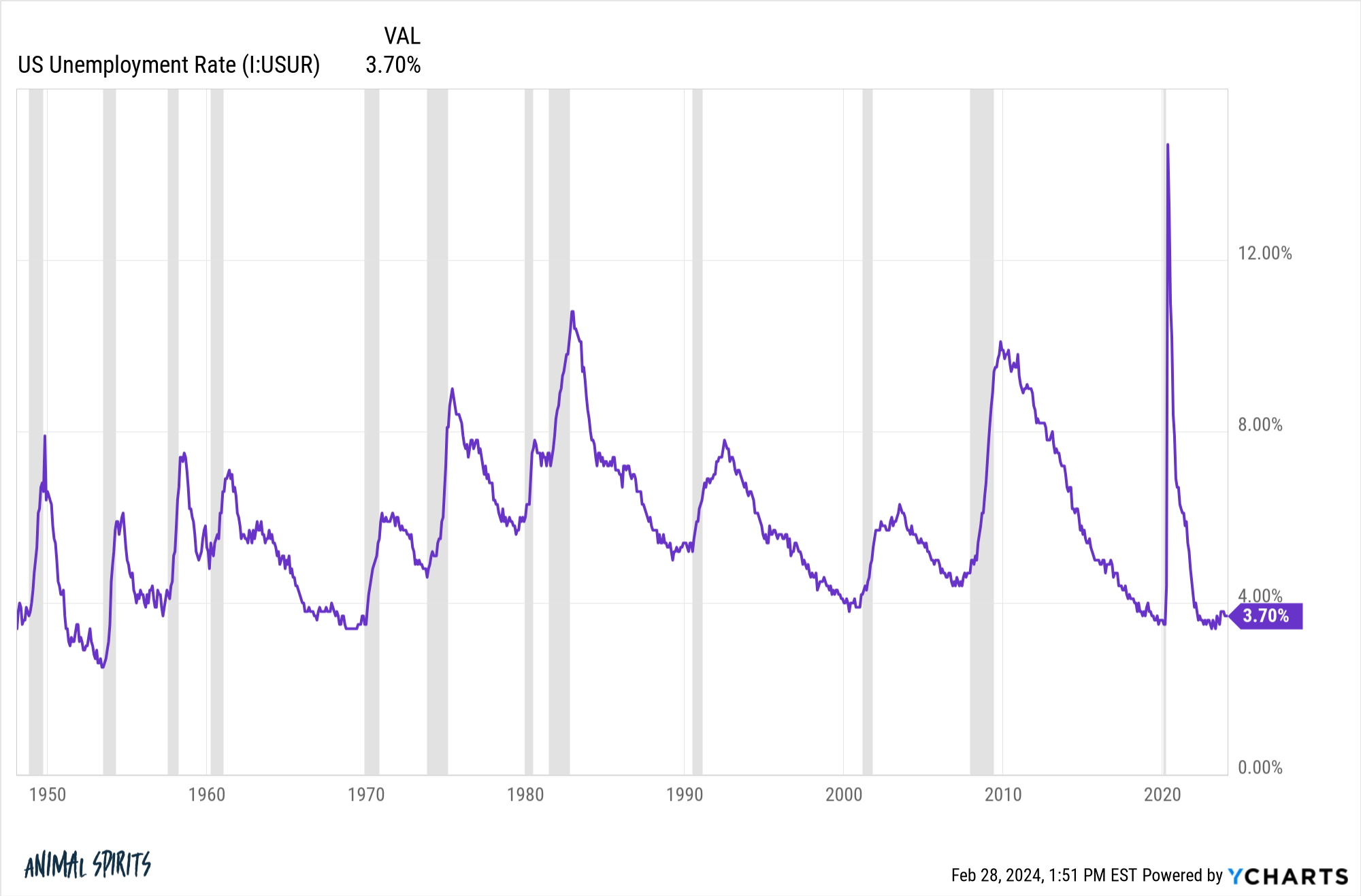

Look at how spaced out those recessions (the grey bars) have become in recent decades:

From the late-1940s through the early-1980s, there was a recession once every three-and-a-half years, on average. Since 1990, there has been one recession every nine years, on average.

We went almost 11 years between the end of the Great Financial Crisis downturn in 2009 and the Covid collapse in the spring of 2020. Yet that two-month recession during the pandemic was self-induced. It wasn’t part of the normal business cycle.

If we exclude that two-month period, we’re now looking at almost 15 years since the last true economic contraction in the United States. There was a hard reset in the economic environment in the spring of 2020 but this expansion has been going on for some time now.

I’m not willing to go out on a limb and predict a recession this year because the economy remains strong by most measures. An unexpected economic slowdown from here is a market risk, though.

Some would say inflation re-accelerating is also a risk.

That makes sense if it means the Fed would be forced to raise rates again. However, with supply chains healed from the pandemic craziness, higher inflation would also likely mean a stronger economy for longer.

That seems like good news to me as long as inflation doesn’t move meaningfully higher.

The least satisfying answer for the biggest risk right now is something coming out of left field. The biggest risks are always the ones you don’t see coming. By definition you can’t predict those risks in advance.1

I’m sure I could come up with some other macro or micro variables like interest rates, valuations or the Fed screwing something up.

The way I see it, any of these economic or market risks are the price of admission when investing. No one ever knows the timing or the magnitude of recessions or bear markets but you know they will happen at some point. Those risks are ever present even if they don’t happen very often.

Therefore, the biggest risk for most investors has nothing to do with the economy or markets at all — the biggest risk is you.

There is a risk that you’ll abandon your investment plan and make a big mistake at the worst possible time.

There is a risk FOMO will cause you to follow others into a lousy investment you don’t understand.

There is a risk you’ll become too complacent when the markets are going up and too scared when markets are going down.

There is a risk you’ll sell all of your stocks and never get back into the market because you become paralyzed with fear of making another mistimed decision.

Risk comes in different forms at different times but never completely disappears, regardless of how you position your portfolio.

Warren Buffett once wrote, “Risk comes from not knowing what you’re doing.”

One of the best risk controls you have as an investor is knowing what you own, why you own it and how long you will own it for.

We spoke about this question on the latest edition of Ask the Compound:

Jonathan Novy joined me on the show this week to discuss a plethora of insurance-related questions: term vs. whole life, when it makes sense to use insurance products as investment vehicles and the different types of life insurance.

Further Reading:

Idiots, Maniacs & the Complexities of Risk

1This might be contrarian of me but I think even an alien invasion would be bullish in the long-term. It would require huge infrastructure spending and we could potentially steal some of their technological capabilities after we defeat them. Win-win.